- Over the past 6 years (2019-2024), the Tier 1 Multistate Operators (MSOs) have generated $2.3B in Cash Flow from Operations; Assuming all unpaid 280E related tax liabilities are satisfied this amount is $1.3 Billion.

- ~$1B is owed in 280E related tax among 4 of the 5 Tier 1 MSOs. Green Thumb Industries remains the outlier.

- Other than the Tier 1, cash flow from operations is insufficient to cover the punitive 280E burden and many have passed payment while the constitutionality of prohibition is being challenged in Federal court.

- Remarkably, Green Thumb Industries retains ~60% of its cash flow after satisfying its tax obligations. To put in perspective big alcohol retains about ~85%-90% but it is federally legal.

- With the elimination of 280E and other prohibition costs (higher cost of capital, compliance, insurance, etc.), industrywide, a significant acceleration in free cash flow profiles will likely materialize.

- With 280E, it is near impossible to achieve a free cash flow yield; Green Thumb Industries and Cresco Labs are the proven exceptions.

Full Article

The inherent complexities and nuances of operating a state-regulated cannabis business are costly and arguably excessive. Capital remains scarce, and investor sentiment is seemingly lower than it has ever been, perhaps due to a lack of policy reform at the federal level as well as an overall slowdown in revenue growth (ongoing price compression, robust illicit market, rising popularity of hemp-derived intoxicants).

No question, IRS code section 280E has been the most significant drain on cash flow because businesses that sell cannabis, even in state-regulated markets, pay income tax based on gross profit, not pre-tax income. Accordingly, while most companies remain unprofitable, federal income tax is paid (or accrued). Adding salt to the wound, unlike any other corporate taxpayer, net operating losses generally cannot be carried forward to offset future taxable income.

However, a group of cannabis operators is now challenging the constitutionality of prohibition in federal court, arguing that current laws are outdated. The timing of a final ruling is unknown, but in the meantime, many have opted to pay taxes at the statutory rate and defer the incremental 280E burden. While the IRS has reiterated its position on the matter, many legal experts have weighed in, suggesting that 280E is not applicable.

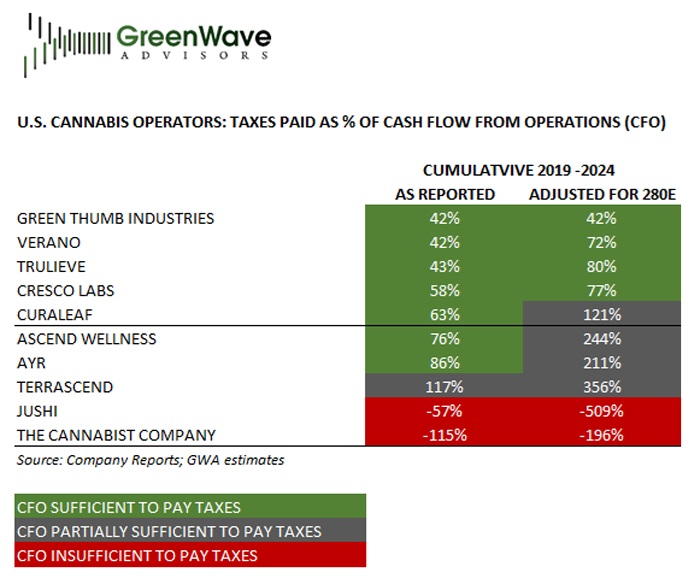

Taxes Paid as a Percentage of Cash Flow From Operations

The heat map below illustrates cash flow and taxes paid as reported for the past 6 years (2019-2024) on a cumulative basis and then adjusted assuming all unpaid 280E tax liabilities are satisfied. As noted, the Tier 1 Multi-State Operators (MSOs) have generated sufficient cash from operations over the years to pay the enormous tax burden associated with 280E. But, with all the other headwinds that come with federal prohibition, keeping up with current tax obligations is becoming more challenging, and the need to conserve cash is a top priority among operators, particularly as sources of capital remain scarce.

Green Thumb Industries (GTI) is the outlier, demonstrating incredible financial discipline over the years and able to satisfy its 280E liability in full. As indicated below, GTI retained ~60% (paid 42% in taxes) of the cash it generated over the past 6 years. To put this in perspective, Big Alcohol retains about 85%-90% of its cash flow.

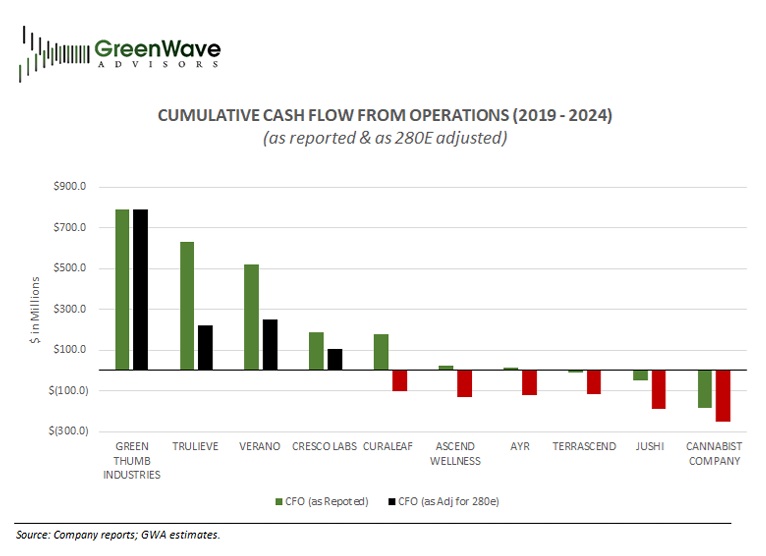

Cash Flow from Operations as Reported and as Adjusted for 280E

The following illustrates the cumulative cash flows from operations as reported and as adjusted for 280E, underscoring the vulnerability to the unpaid 280E burden. Because Curaleaf and Cresco Labs halted 280E-related tax in Q2:24, 75% of its 2024 280E is used in these calculations (i.e., the full year is realized: Q4:23 paid in Q1:24 plus 75% of 2024).

Suffice it to say that if the IRS position is sustained, it would likely not seek an immediate payment in full but rather establish an installment option, similar to Statehouse Holdings in pursuing its uncollected taxes.

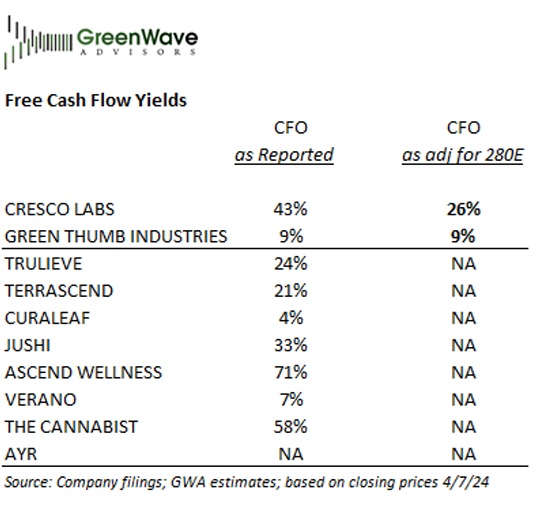

280E and Free Cash Flow Yield

To state the obvious, 280E has a material impact on Free Cash Flow yield. Assuming unpaid 280E is satisfied, Green Thumb Industries and Cresco Labs are the only operators that offer investors an FCF yield. With the elimination of 280E and other prohibition costs (higher cost of capital, compliance, insurance, etc.), industrywide, a significant acceleration in free cash flow profiles will likely materialize.

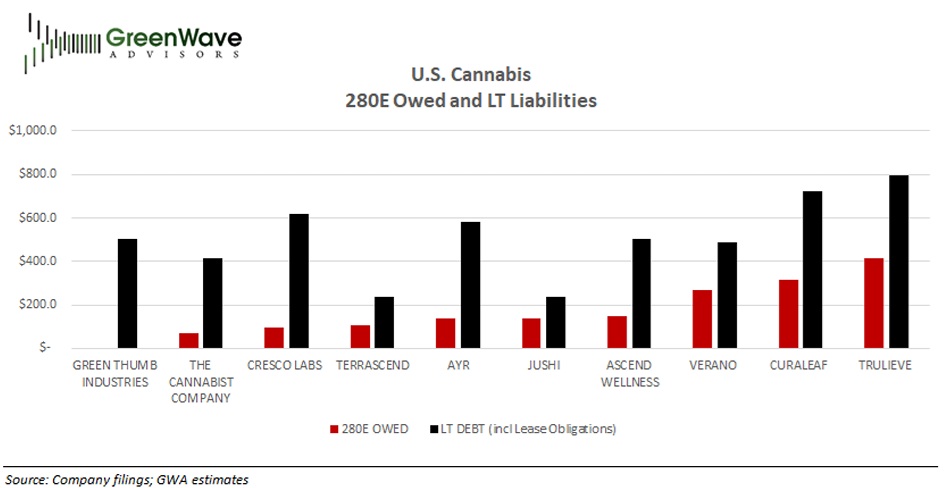

Should Unpaid 280E Liabilities Be Included in Total Debt?

Finally, this chart illustrates the unpaid 280E liability and Long Term Debt. The incremental burden associated with this tax could have a material impact on leverage and creditworthiness.