The GreenWave

Buzz

In The

News

GreenWave

Capital Partners

Featured

ONE STEP FORWARD ON THE ROAD TO FEDERAL REFORM

The announcement last week by the department of Health and Human Services (HHS) that it is now recommending the rescheduling of cannabis from schedule I to III, marks a significant inflection point for federal cannabis reform. The timing of the Drug Enforcement Agency...

STIRRING THE POT IN CALIFORNIA: CANNABIS SALES OVERSTATED BY $6 BILLION (2018-2022)

Beginning in Q1:23, California cannabis excise tax reporting shifted from distributor to retailer. With this change, the state provides an added layer of transparency in reporting cannabis sales. Our analysis reveals that prior period revenues (2018-2022) are...

The GreenWave Buzz – May 3, 2023

The long-term prospects for industry growth remain compelling as more states legalize cannabis. Near-term fundamentals are hampered by a thriving illicit market, lack of law enforcement, price compression and added costs associated with prohibition most notably, the...

Terrascend Sets In Motion Up-listing to the Toronto Stock Exchange

TERRASCEND SETS IN MOTION UP-LISTING TO THE TORONTO STOCK EXCHANGE Last week, Terrascend announced that it filed an application to list its shares on the Toronto Stock Exchange (TSX). The company indicates that in order to qualify for listing, it will need to...

Recent Headlines, Commentary and Upcoming Catalysts – 9/9/2022

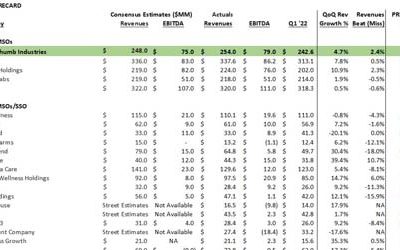

Q2 Earnings Season Recap Generally speaking, the larger MSOs continue to execute, while it’s becoming increasingly more challenging for the smaller players to scale and generate cash flows needed to support current operations. Q2 revenues were in line with our...

Q2 Earnings Season Commentary – 9/1/2022

Summary Generally speaking, the larger MSOs continue to execute, while its becoming more of a struggle for the smaller players to scale and generate cash flows needed to support current operations. Q2 revenues came in as expected – minimal sequential growth, but...

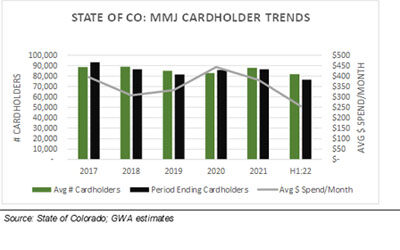

Colorado Market Declining and Takes Another Big Hit in Q2 – 4th Consecutive Quarter with Negative Comps

For the fourth consecutive quarter, The Colorado Department of Revenues posted negative comps both QoQ and YoY. For the six months ending June 30th, sales have fallen 21% to $906M mostly driven by a precipitous drop in Medical Marijuana (-46% ) due to new...

Recent Headlines, Commentary and Upcoming Catalysts

REGULATORY A Federal de-criminalization bill introduced in the Senate; not likely to pass but sets in motion further discussions. The Cannabis Administration and Opportunity Act (CAOA), was introduced into the Senate last month ( drafted March 2021). We share the...

Deal or No Deal?

Northern Lights Acquisition Corp (NLIT) extended the closing of its business combination with Safe Harbor Financial to July 29th (but could go to August 31st ) as the company waits for regulatory approval. An extension is not uncommon (i.e. last year,...

Northern Lights Acquisition Corp / Safe Harbor Financial Business Combination

KEY POINTS Northern Lights Acquisition Corp will de-SPAC into Safe Harbor Financial (SHF) for $185M pending shareholder approval on 6/24. Deal valued at 9.1x ’23 EV/EBITDA vs 9.7x peer group average Enterprise Value /IPO 0x vs Cannabis SPAC average of 3.0x Redemption...

Colorado’s Medical Marijuana Market Takes A Big Hit

KEY POINTS For the third consecutive quarter, The Colorado Department of Revenue posted neg comps for cannabis both YoY and QoQ. Q1:22 results -41% med / -13% rec YoY and -23% med / -11% rec QoQ. The deceleration in revenue growth is consistent with what we...

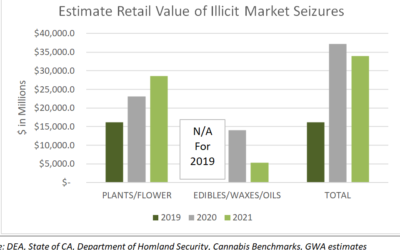

Weeding Out the Illicit Market

TAKEAWAY We reviewed and analyzed cannabis confiscations and related activities that were published by various state and federal agencies that enables us to determine a floor value for the illicit market. Its growth seemingly outpaced that of the legal market post...

FAQ

In The News

Archived Research Reports

Who We Are And Why Are We Different

The firm was founded in March, 2014 by Matt Karnes, noted as one of the first to bring a professional pedigree to the emerging and complex cannabis industry. His tenure includes: Sellside Equity Research (Bear Stearns (JPMorgan), SG Cowen (Cowen), First Union Securities (Wells Fargo), Buyside Equity Analyst (L/S Equity Hedge Fund), Big 4 Public Accounting (PwC, Deloitte), Fortune 50 (Texaco Inc, Chase Bank). This wide range of experience establishes the firm's unique positioning as a trusted source readily able to connect the dots, read between the lines and ask the difficult and sometimes probing questions.

What We Do

We provide:

- Independent Financial Research and Analysis

- Buyside& Sellside Financial Analysis and Due Diligence

- Fund Manager and Direct Investment Due Diligence

- Valuation Services

- Cap Intro Advisory

To learn more, contact us at info@greenwaveadvisors.com

Our clients include:

- Institutional Investors

-

- Mutual Funds

- Hedge Funds

- Private Equity

- Venture Capital

-

- Family Offices

- High Net Worth Individuals

- Investment Banks (Equity Research)

- Cannabis License Applicants

- Cannabis Start Ups

The GreenWave Buzz – our proprietary analysis and commentary on what’s relevant in the cannabis space

Matthew A. Karnes, CPA

Founder

Matthew (Matt) Karnes has over 25 years of diverse finance and accounting experience. Prior to founding GreenWave Advisors LLC, Matt worked in equity research focusing on the Radio Broadcasting and Cable Television industries for First Union Securities. Matt also covered Satellite Communication at SG Cowen and in addition, worked with the top ranked Consumer Internet analyst at Bear Stearns & Co – this team was consistently recognized by the Institutional Investor’s “All America Research Team”. As a sellside equity analyst, Matt authored and co-authored numerous emerging industry research reports including such names as Google, Sirius, XM Satellite Radio, DIRECTV and EchoStar Communications.